The Best Resources For Selling Junk Cars

Learn the basics about junk cars, including ownership, maintenance, scrapping, and selling. And when ready, turn to Junk Car Medics to get the most cash for your junk car.

Starting with your VIN will get you the most accurate offer.

Starting with your VIN will get you the most accurate offer.

We Make Selling Junk Cars Quick, Easy, and Painless

Welcome to the best place to learn how to sell junk cars for cash online. Junk Car Medics has purchased 100,000's of scrap cars nationwide since 2015. Over that time we have gained a bit of knowledge about buying junk cars and we want to share it with you to make selling junk cars simpler.

Learn everything from how much they are worth and current prices, selling a clunker for the most cash, and who pays the most cash.

But first, get started learning with our overview of a junk car.

A junk car, also termed a scrap car, is a vehicle that may still run but is unsafe due to significant damage or mechanical failure. These cars are not worth repairing and are typically unsuitable for use on public roads. Its remaining value lies in the parts that can be salvaged and the scrap metal it provides. […]

What is a junk car?Popular Articles About Selling Junk Cars

View the most popular articles on Junk Car Medics that cover the junk car selling process from prices to how-to's.

Sell Your Junk Car For Cash Get $500, $1,000, and up to $1,500 for Junk Cars Looking to sell your junk car for the most cash? Junk Car Medics pays $100 to $5,000 cash for […]

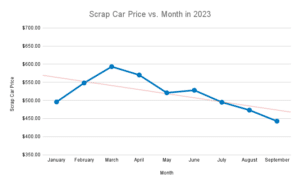

View The Current Price Range for Scrap Cars in 2024 Currently scrap car prices per ton range from $145 – $195/ton in the USA, making the average midsize car (1.5 ton, 3000lbs) valued at $217.50 […]

Most Recent Articles Related to Selling Junk Cars

-

Junk Your Car No Title – Get up to $500 Cash for Junk Cars Without Title

Can you junk your car without a title and still get cash? The answer is yes, but it’s essential to understand the process and legal […]

Read More -

How to Sell a Car for Parts, Step-By-Step

If you have an old or unreliable car, your first thought might be that it would be best sold for parts rather than selling it […]

Read More -

Who Pays The Most For Junk Cars?

Who pays the most for junk cars is a common question that the Junk Car Medics staff always hears because we buy junk cars. The […]

Read More

Junk Car Guides

Learn more about junk cars, how to care for them, the dangers, and how to turn them into cash with our expert guides covering the junk car industry.

-

20 Reasons People Junk Cars Based on Survey of 1,503 People

As someone deeply involved in the car industry, particularly in buying junk cars, I’ve always been intrigued by the stories behind why people decide to […]

Read More -

Vehicle Title: Definition, Types, and Purposes

A car title is a document that establishes ownership of a vehicle. One must purchase a car from a dealership or private seller to get […]

Read More -

How Much is Your Junk Car Worth?

February’s Average Price $626 January’s Average Price $570 /ton Monthly Increase of 10% Yearly Gain of 10% How Much is My Junk Car Worth? Junk […]

Read More -

How to Donate a Car to Charity in Los Angeles

To donate a car in Los Angeles is one of the most rewarding ways to get rid of an unwanted car. Donating an unwanted car […]

Read More -

How to Scrap (Junk) a Car in Los Angeles

To scrap a car in Los Angeles for cash one must have the knowledge, time, and resources to do so. Scrapping a car for cash […]

Read More -

Junking a Car With No Title in Los Angeles

Junking a car with no title is possible in Los Angeles, as long as you can prove ownership and meet other requirements. Selling a junk […]

Read More -

What Do You Need to Sell a Junk Car in Los Angeles?

To sell a junk car in Los Angeles one must be able to prove ownership and provide details of the vehicle. This is the most […]

Read More -

Who Buys Junk Cars in Los Angeles, CA?

Searching for a junk car buyer in Los Angeles? Wondering who buys junk cars near you in the area? Listed below are 9 junk car […]

Read More -

How to Prepare for Junk Car Removal in Los Angeles

Preparing for junk car removal in Los Angeles is a vital step to selling your junk car. Junk car removal in Los Angeles may be […]

Read More -

How Long Do Chevrolet Malibus Last?

According to Junk Car Medics data, Chevrolet Malibus lasts an average lifespan of 16 years, or vehicle model year 2008, and 148,351 miles. A well-maintained […]

Read More -

How Long Do Ford F-150s Last?

According to Junk Car Medics data, Ford F-150s last an average lifespan of 21 years, or vehicle model year 2003, and 178,174 miles. A well-maintained […]

Read More -

How Long Do Toyota Camrys Last?

According to Junk Car Medics data, Toyota Camrys last an average lifespan of 21 years, or vehicle model year 2003, and 179,174 miles. A well-maintained […]

Read More -

How Long Do Nissan Altimas Last?

According to Junk Car Medics data, Nissan Altimas last an average lifespan of 16 years, or vehicle model year 2008, and 154,546 miles. A well-maintained […]

Read More -

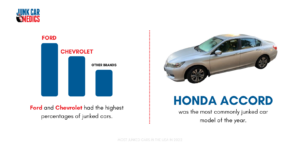

How Long Do Honda Accords Last?

According to Junk Car Medics data, Honda Accords can last an average of 22 years (vehicle model year 2002) and 176,988 miles. A well-maintained Honda […]

Read More -

How Long Do Honda Civics Last?

According to Junk Car Medics data, Honda Civics last an average lifespan of 21 years, or vehicle model year 2003, and 170,948 miles. A well-maintained […]

Read More -

How to Get Rid of Rust From a Car

Rust on your vehicle isn’t just unsightly-it’s a sign your car needs help. This article cuts straight to the chase, offering hands-on solutions for how […]

Read More -

17 Things to Do BEFORE You Junk Your Car

The time has come. The car that was just barely getting you around will no longer do its job. It may have a LOT of […]

Read More -

Most Common Junk Cars in 2023

People junk cars for various reasons. But at the end of the day, “junk cars” are usually old, damaged, beyond repair, or unsafe to drive. […]

Read More -

7 Tips to Negotiate The Best Price When Selling a Junk Car

Nobody wants to get lowballed on the value of their junk car. Negotiation tactics may need to be used to get the best price. Every […]

Read More -

5 Reasons to Avoid Selling Your Junk Car on Craigslist

After you have made peace with owning a junk car, the next step is getting cash for your junk car. You can use numerous avenues […]

Read More