Sell Junk Car For Cash as Fast as Today

Selling a junk car is the #1 way to get paid cash for getting rid of an old unwanted vehicle. Selling junk cars is the process of getting cash for junk cars from a junk car buyer. Use Junk Car Medics' instant valuation tool to get a top dollar offer to sell your car.

Starting with your VIN will get you the most accurate offer.

Starting with your VIN will get you the most accurate offer.

Get an Instant Offer

Answer basic questions about your vehicle online or by phone. Quick.

Accept Your Offer

Accept your offer right away or think about it for 5 days. Easy.

Get Cash For Your Junk Car

Schedule removal and get paid on the spot for your junk car! Painless.

Selling a junk car should be quick, easy, and painless no matter what condition it's in.

Whether it's new, used, totaled, flooded, damaged, or otherwise junk, we'll give you an offer in less than 2 minutes to get cash for junk cars.

All you need is your title and vehicle registration, and we'll buy your car for cash and a tow truck driver will come to you to remove it.

Everything Needed to Sell Your Junk Car For Cash

Every car becomes junk at the end of its useful life. At that time the vehicle owner must figure out the best way to sell a junk car. Selling junk cars is different from the usual process of selling a used car. The buyers, strategies, and processes are different because junk cars need to be scrapped and processed for recycling. Junk cars are vehicles that are no longer operational. Used car buyers and dealerships don't have the processes in place for handling scrap car sales.

Therefore a whole new market of car buyers emerges for junk cars. Junkyards (also known as auto salvage yards), online cash for car services, car auctions, and private buyers are among the places that buy junk cars.

Selling a junk car involves contacting these buyers to get offers. Getting offers for your specific vehicle is the best way to determine its value. Get offers from 3 or more junk car buyers to make sure you are getting accurate quotes.

Get started by generating an offer to sell your junk car.

Now, let's take a look at the process, requirements, and values for selling junk cars.

What is The Process For How to Sell a Junk Car?

The 6 steps to sell a junk car are listed below:

- Prepare for Selling Your Junk Car:

- Gather necessary documents needed, such as the title, registration, and any maintenance records.

- Clean your car of any valuables or personal items worth keeping.

- Remove any valuable parts or accessories that you can sell separately.

- Search Out Junk Car Buyers and Get Multiple Offers:

- Research local junk car buyers, salvage yards, and online platforms that specialize in buying junk cars.

- Contact several buyers to get quotes for your car. Provide them with details about your car's condition, make, model, and year.

- Compare Buyers and Offers and Choose the Best One:

- Evaluate the offers based on the price, services provided (such as free towing), and payment terms.

- Consider the reputation and reliability of the buyers.

- Accept an Offer and Schedule the Removal:

- Once you've chosen a buyer, accept their offer and arrange a convenient time for them to pick up your car.

- Ensure that the agreed-upon terms, such as the price and removal date, are clearly communicated.

- Sign Over the Title and Get Paid for Selling Your Junk Car:

- Complete the necessary paperwork to transfer ownership of the car to the buyer. This usually involves signing over the title.

- Receive payment according to the agreed-upon method (cash, check, etc.). Make sure to get a receipt or proof of payment.

- Notify the DMV to Complete Your Sale:

- Inform the Department of Motor Vehicles (DMV) that you have sold your car. This is important for releasing liability.

- They will assist you with removing the vehicle from your insurance and canceling your registration. Make sure to follow their specific instructions for your state.

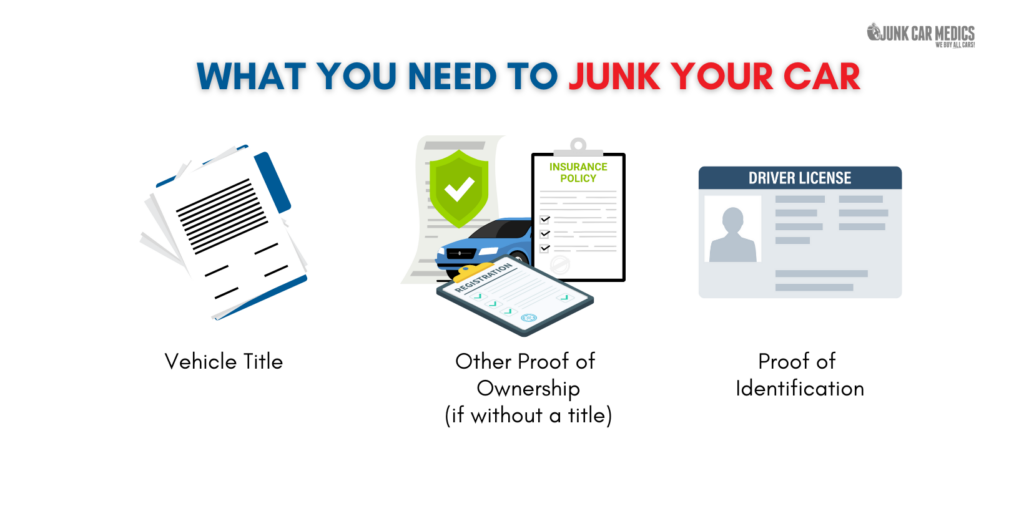

What Items Are Needed to Sell a Junk Car?

The seven items needed to sell a junk car are listed below:

- Proof of Ownership:

- Vehicle title in your name or prove ownership in other ways such as the bill-of-sale and registration in your name.

- Personal identification is also required.

- Vehicle Registration:

- The current or expired registration to prove the vehicle is not stolen.

- Valid Photo ID:

- A government-issued photo ID (such as a driver's license or passport) to verify your identity.

- Bill of Sale:

- Some buyers may require a bill of sale for their records, which documents the transaction details.

- Keys to the Car:

- While not always required, having the keys can increase the value of your offer.

- Loan Payoff Information (if applicable):

- If there is a lien on the vehicle, you'll need to provide information about the loan and arrange for the payoff.

- Odometer Reading:

- Some states require an odometer disclosure statement for vehicles of a certain age.

How Much Can I Sell a Junk Car for?

$100 - $1,000 is the range for selling junk cars. When selling, the actual amount you will receive depends on various factors that impact junk car prices such as the vehicle, its condition, and its weight.

What Factors Determine The Value of a Junk Car?

The 7 factors that determine what a junk car is worth are:

- Vehicle Year, Make, and Model

- Vehicle Condition

- Vehicle Parts

- Vehicle Weight

- Local Scrap Metal Prices

- Vehicle Title Status

- Vehicle Location

How do I Maximize The Value of My Junk Car?

Selling your car for parts is the best way to maximize its value. Stripping the parts and selling them locally or on eBay will get you the most money for them as you will cut out the middleman (junkyard). However, stripping a car of its parts requires technical knowledge and skill. You may also have a hard time finding buyers of old car parts as it is easier for them to go right to a junkyard to purchase.

Being able to sell your car's parts individually will net you more money and you can then sell the remaining vehicle shell and metal to a local metal recycling facility. Make sure to line up a buyer for your used car parts before removing them as to not waste your time. If the parts are removed junk car buyers will pay less for the vehicle.

You can also negotiate the sale price of your junk car to wiggle more cash from your buyer. Go in knowing your cars condition and if it has valuable parts and you'll have a leg up.

Lastly, make sure to have the vehicle title to maximize the price. Junk car buyers will pay less for titleless vehicles, if they are even able to buy them. It is more profitable to obtain a replacement title for your vehicle before selling it.

Can I Sell My Junk Car for $500 to $1,000 Cash?

The answer is yes, depending on various factors such as the car's make, model, condition, and current market prices for scrap metal in your area. If your car has valuable parts or is in reasonable condition, you could easily receive $500 and up to $1,000 cash for junk cars.

Here are 5 vehicles that you can sell for $500 or more in scrap:

| Vehicle | Offer Price |

| 2010 Ford F-150 | $550 |

| 2013 Ford Taurus | $590 |

| 2013 Nissan Sentra | $660 |

| 2014 Chevrolet Malibu | $525 |

| 2011 Jeep Grand Cherokee | $895 |

Here are 5 vehicles that you can sell for $1,000 or more in scrap:

| Vehicle | Offer Price |

| 2014 Hyundai Sonata | $1275 |

| 2011 Toyota RAV4 | $1320 |

| 2015 Ford Explorer | $1000 |

| 2012 BMW 3-Series | $1025 |

| 2014 Dodge Challenger | $1500 |

Don't settle for less – contact us for a free quote and see if your junk car can bring you $1,000 cash!

How Can Sellers Guarantee Receiving a Good Price?

Obtaining junk car offers from multiple buyers is the best way to guarantee you receive a good price when you sell your junk car. Obtaining multiple offers allows you to see the true value of your clunker and what various places will pay. Additionally, finding out the local scrap metal price can be helpful.

Why is Junk Car Selling Important?

Junk car selling is an important aspect of the automotive and recycling industries, serving an economic and environmental purposes. Junk car selling involves knowing the signs its time to junk your car and then selling it. Selling a junk car allows owners to rid themselves of a vehicle that has problems and issues that cause it to be unsafe to drive.

Here are the main reasons why selling junk cars is important:

- Environmental Benefits:

- Recycling: Junk cars are a valuable source of recyclable materials such as used car parts and scrap metal. By selling a junk car, you contribute to the recycling process, which helps conserve natural resources and reduce the need for new raw materials.

- Reducing Pollution: Proper disposal of junk cars ensures that hazardous materials, such as oil, coolant, and battery acid, are safely removed and disposed of, preventing environmental contamination.

- Energy Conservation: Recycling metal from junk cars requires less energy than producing new metal from ore. This energy savings translates into reduced greenhouse gas emissions.

- Economic Impact:

- Supporting the Recycling Industry: Junk car selling supports the automotive recycling industry, which is a significant sector of the economy. This industry employs thousands of people and contributes billions of dollars annually to the US economy.

- Cost Savings: Recycling materials from junk cars helps reduce manufacturing costs for new vehicles and parts, as recycled metal is often cheaper than new metal.

- Local Economies: Junk car buyers and salvage yards are often local businesses that contribute to the economic health of their communities.

- Personal Benefits for Sellers:

- Financial Gain: Selling a junk car provides the owner with immediate cash ($100 - $1,000 on average), which can be used for various purposes.

- Space Clearing: Removing a junk car frees up space in a driveway or garage, improving the property's appearance and usability.

- Convenience: Selling a junk car is a quick and easy way to dispose of an unwanted vehicle, without the hassle of trying to repair or sell it privately.

- Safety and Legal Compliance:

- Reducing Hazards: Junk cars can become safety hazards, especially if they are left to deteriorate in public areas or on personal property.

- Legal Compliance: Proper disposal of junk cars ensures compliance with local regulations regarding vehicle disposal and environmental protection.

As you can see, selling a junk car plays an important role in promoting environmental sustainability, supporting the economy, providing personal benefits to sellers, and making sure of safety and legal compliance. This is the most practical and responsible way to handle end-of-life vehicles ready for recycling.

How Does Junk Car Selling Address Environmental Concerns?

By promoting the recycling of materials and safe disposal of hazardous waste. When a junk car is sold the process involves dismantling the vehicle to recover metals and other reusable components. This in turn reduces the need for as many new raw materials and conserves natural resources. The disposal of hazardous waste like batter acid ad coolant prevents environmental contamination. Overall, selling junk cars contributes to sustainability by reducing waste, lowering greenhouse gas emissions, and supporting the local automotive recycling economy.

What Are The Legal Regulations For Selling a Junk Car?

Various states have different regulations for how a junk car can be handled and sold. Sellers and buyers must both comply. Here are some examples of state laws regarding the sale of junk cars:

- California: In California, the Department of Motor Vehicles (DMV) requires that a vehicle be designated as "salvage" if it has been damaged to the extent that the cost of repairing the vehicle exceeds its value before it was damaged. When selling a salvage vehicle, the seller must provide the buyer with a completed Application for Salvage Certificate or Nonrepairable Vehicle Certificate (Form REG 488C) and disclose the vehicle's salvage status.

- Texas: Texas law requires that any person or entity engaged in the business of acquiring, selling, dismantling, or repairing salvage motor vehicles must be licensed as a salvage vehicle dealer. When selling a junk vehicle, the seller must provide the buyer with a properly assigned title, including the designation of the vehicle as "salvage" if applicable.

- Florida: In Florida, a Certificate of Destruction is issued for vehicles that are deemed not suitable for repair and can only be sold for parts or scrap. The seller must disclose the status of the vehicle to the buyer, and the vehicle cannot be rebuilt or titled for use on public roads once a Certificate of Destruction has been issued.

- New York: In New York, a vehicle is considered a "salvage vehicle" if it is eight model years or newer and has been damaged to the extent that the cost of repair exceeds 75% of its pre-damage value. When selling a salvage vehicle, the seller must provide the buyer with a Salvage Certificate (MV-907A) and disclose the vehicle's salvage status.

- Illinois: Illinois requires that a vehicle be designated as "salvage" if it has been damaged to the extent that its estimated cost of repair exceeds its fair market value. When selling a junk vehicle, the seller must provide the buyer with a Salvage Certificate issued by the Illinois Secretary of State and disclose the vehicle's salvage status.

You can junk a car in California under the Consumer Assistance Program. Under this environmental initiative, 'the Bureau of Automotive Repair’s (BAR) Consumer Assistance Program (CAP) offers eligible consumers repair assistance and vehicle retirement options to help improve California's air quality.'

CAP (Vehicle Retirement) allows residents to retire cars that fail the state's smog/emissions test. If the car is operable, California-registered, and you are the owner, you could receive between $1,000 and $1,500 for signing over the car to a junkyard or recycling center. Alternatively, you could claim up to $1,200 to repair your emissions system to meet the smog standards.

These laws vary from state to state, so it's important for sellers and buyers of junk cars to familiarize themselves with the specific requirements in their respective states.

Can I Sell a Junk Car Without The Title?

You can sell junk cars with no title in certain states and under certain situations. Most states require a replacement title before allowing junk cars to be sold.

When you junk a car, you must transfer ownership to the buyer, relieving yourself of any further responsibility.

The paperwork for junking a car includes the following:

- The title

- Most recent registration

- Your driver's license

- Lien release from the financing company to confirm the car is paid up (if applicable)

- A bill of sale to document the transaction

- An Odometer Disclosure (confirming the mileage) may be necessary for newer cars - generally under ten years old.

In states where you can sell a junk car with no title the price will be lower than it would if it had the title.

Consequences of Violating Junk Car Selling Laws

Violating laws related to the selling of junk cars can lead to various consequences, ranging from fines and penalties to legal actions and loss of business licenses. Here are some specific examples:

- Fines and Penalties: One of the most common consequences of violating junk car selling laws is the imposition of fines. For example, in Texas, selling a salvage vehicle without disclosing its status to the buyer can result in a fine of up to $10,000 per violation. Similarly, in California, failure to properly transfer a salvage title can result in fines and penalties.

- Revocation of Licenses: Businesses that consistently violate junk car selling laws may face revocation of their licenses. In Illinois, for instance, a salvage dealer's license can be revoked for failing to comply with the state's regulations on salvage vehicles, including proper documentation and disclosure.

- Legal Actions and Lawsuits: Sellers who fail to disclose the salvage status of a vehicle or engage in fraudulent activities may face legal actions, including lawsuits from buyers. In New York, consumers have the right to sue for damages if they are sold a salvage vehicle without proper disclosure. The seller may be liable for compensatory damages, punitive damages, and attorney fees.

- Criminal Charges: In some cases, violating junk car selling laws can lead to criminal charges. For example, in Florida, knowingly selling a vehicle with a fraudulent odometer reading (a common issue with salvage vehicles) is a third-degree felony, punishable by up to five years in prison.

- Reputational Damage: Beyond legal and financial consequences, violating junk car selling laws can damage a business's reputation. Consumers are more likely to avoid dealers with a history of legal issues, leading to a loss of trust and a decrease in business.

To avoid these consequences, it is crucial for sellers of junk cars to comply with state laws, provide clear and honest disclosures to buyers, and maintain accurate records of all transactions.

Junk Car Selling and the Automotive Recycling Industry

Junkyard bound cars plays a vital role in supporting the automotive recycling industry, which is a crucial component of the larger environmental sustainability effort. Here are some key points backed by statistics and data:

- Volume of Recycled Vehicles: According to the Automotive Recyclers Association, approximately 12 to 15 million vehicles reach the end of their life each year in the United States alone. These vehicles become a significant source of materials for the recycling industry.

- Recycling Rate: The automotive recycling industry boasts an impressive recycling rate. It is estimated that over 80% of a vehicle's material content is recyclable, making automobiles one of the most recycled consumer products.

- Environmental Impact: Recycling junk cars has a significant environmental impact. The Automotive Recyclers Association reports that the industry saves an estimated 85 million barrels of oil annually that would have been used in the manufacturing of new or replacement parts.

- Economic Contribution: The automotive recycling industry is not only environmentally beneficial but also economically significant. It contributes over $25 billion per year to the national GDP, according to the Institute of Scrap Recycling Industries.

- Resource Conservation: Recycling metals from junk cars conserves natural resources. For example, recycling steel requires 60% less energy than producing steel from raw materials, resulting in a reduction of greenhouse gas emissions.

By recycling materials from end-of-life vehicles, the industry reduces the need for new raw materials and minimizes the environmental impact of automotive production and waste.

Selling a Non-Running or Damaged Car: Similarities to Selling Any Junk Car

Selling a non-running or damaged car is, in many ways, similar to selling any junk car. Here are some key points to consider:

- Junk Car Buyers: Just like any junk car, non-running or damaged cars are often sold to junk car buyers or salvage yards. These buyers typically evaluate the car based on its weight, salvageable parts, and scrap metal value.

- Towing Requirements: If the car doesn't run, it will likely need to be towed to the buyer's location. Many junk car buyers offer free towing services, but it's important to confirm this before finalizing the sale. If the car is drivable, you may be able to drive it to the buyer, which could potentially increase its value.

- Flatbed Towing for Extensive Damage: In cases where the car is severely damaged, such as missing a wheel or having significant structural damage, a standard tow truck may not be sufficient. A flatbed towing service will be required to safely transport the vehicle. This is a common scenario for both damaged cars and junk cars that are in particularly poor condition.

- Documentation: Regardless of the car's condition, you'll need to provide the necessary documentation to sell it. This typically includes the title and a bill of sale. Make sure to check your state's specific requirements for transferring ownership of a non-running or damaged vehicle.

- Price Expectations: As with any junk car, the price you can expect for a non-running or damaged car will be based on its scrap value and any salvageable parts. It's unlikely to be a high amount, but it can still provide some financial return and free up space on your property.

- Environmental Considerations: Selling a non-running or damaged car to a reputable junk car buyer ensures that the vehicle is recycled in an environmentally responsible manner. This is a key consideration for both typical junk cars and those that are non-running or damaged.

The main differences lie in the towing requirements and potentially the degree of damage, which can affect the car's value and the logistics of its removal.

Tax Implications of Selling a Junk Car

When selling a junk car, there are a few tax implications that you should be aware of:

- Income Reporting: If you sell a junk car for more than its original purchase price, which is rare but possible if the car has valuable parts or is a collector's item, you may need to report the profit as income on your tax return. However, most junk cars are sold for less than their original purchase price, so this situation is uncommon.

- Sales Tax: Generally, when you sell a personal vehicle, including a junk car, you are not responsible for collecting sales tax on the transaction. The buyer may be responsible for paying sales tax when they register the vehicle or use its parts, but this varies by state.

- Charitable Donations: If you donate your junk car to a qualified charitable organization, you may be able to claim a tax deduction. The deduction is usually based on the fair market value of the car, which can be determined using a guide like Kelley Blue Book or a written appraisal. Make sure to obtain a receipt from the charity and itemize your deductions on your tax return.

- Business Use: If you used the junk car for business purposes, you might be able to claim a loss on the sale of the vehicle as a business expense. This could be applicable if you used the car for deliveries, transportation, or other business-related activities.

- Record Keeping: It's important to keep records of the sale, including the sale price, any expenses related to the sale, and information about the buyer. These records can be useful if you need to prove the transaction's details for tax purposes.

It's always a good idea to consult with a tax professional or accountant to understand the specific tax implications of selling a junk car in your situation, as tax laws can vary by state and individual circumstances.

Who Pays the Most for Junk Cars?

The amount paid for junk cars can vary significantly based on various factors, including but not limited to the specific vehicle, the buyers available in the area, and other market conditions. These factors can influence the demand and value of a junk car, leading to different offers from potential buyers.

While it's important to consider these variables, Junk Car Medics is known for providing competitive offers for junk cars. They take into account the unique aspects of each vehicle and the current market conditions to ensure that sellers receive the best possible price. With their streamlined process, car owners can quickly get quotes and sell their junk cars with ease.

Key Players in the Junk Car Selling Industry

The junk car selling industry is composed of various types of businesses and organizations, each playing a crucial role in the process of buying, selling, and recycling junk cars. Here are some of the key players:

- Junk Car Buyers and Salvage Yards: These businesses specialize in purchasing junk cars from individuals. They typically offer cash for cars, regardless of their condition, and make money by selling the usable parts or recycling the metal.

- Auto Salvage Auctions: Auctions are a platform where insurance companies, banks, and other entities sell salvage vehicles, including junk cars, to the highest bidder. These auctions are often attended by salvage yards, rebuilders, and individual buyers.

- Online Car Buying Services: Companies like Junk Car Medics operate online platforms where car owners can get instant quotes and sell their junk cars quickly and conveniently. These services have become increasingly popular due to their ease of use and competitive offers.

- Scrap Metal Recyclers: These businesses purchase junk cars primarily for their metal content. They dismantle the cars and recycle the metal, contributing to environmental sustainability by reducing the need for new metal production.

- Automotive Parts Recyclers: Also known as auto dismantlers, these businesses focus on salvaging usable parts from junk cars. The parts are then cleaned, tested, and resold to individuals or repair shops.

- Environmental Agencies and Organizations: While not directly involved in buying or selling junk cars, these entities play a crucial role in regulating the industry to ensure environmentally responsible disposal and recycling practices.

These key players work together to form a complex ecosystem that supports the efficient and sustainable handling of junk cars, from their initial purchase to their final recycling or disposal.

What Resources Are Available for Sellers of Junk Cars?

Sellers of junk cars have access to various resources to help them navigate the process and get the best deals. Some of these resources include:

- Online Valuation Tools: Websites that buy junk cars offer online valuation tools where sellers can input details about their car and receive an instant quote for its value.

- Local Salvage Yards and Junkyards: These businesses can provide quotes for junk cars and often offer towing services to remove the car from the seller's property.

- Online Marketplaces: Platforms like Craigslist, eBay Motors, and Facebook Marketplace allow sellers to list their junk cars and reach potential buyers directly.

- Auto Auctions: Some auto auctions specialize in salvage vehicles, providing a venue for sellers to auction off their junk cars to the highest bidder.

- State DMV Websites: Many state DMV websites provide information on the legal requirements for selling a junk car, including title transfer and notification of sale.

Most Popular Cities for Selling Junk Cars in the US

- Los Angeles, CA: High population density and heavy traffic lead to a high turnover of vehicles.

- New York, NY: The largest city in the US has a constant demand for used car parts and scrap metal.

- Chicago, IL: Harsh winters contribute to vehicle wear and tear, increasing the market for junk cars.

- Houston, TX: A sprawling city with a large market for used vehicles and parts.

- Phoenix, AZ: High temperatures can accelerate vehicle aging, creating a demand for junk car services.

- Philadelphia, PA: Dense urban environment with a steady need for affordable car parts from junk vehicles.

- San Antonio, TX: Growing population and a strong automotive culture contribute to a vibrant junk car market.

- San Diego, CA: High cost of living leads many to opt for used parts from junk cars for repairs.

- Dallas, TX: A major economic hub with a significant number of vehicles reaching the end of their life cycle.

- San Jose, CA: The tech-driven economy results in a fast turnover of vehicles, increasing the supply of junk cars.

- Detroit, MI: The Motor City has a long history with the automotive industry, including a market for junk cars.

- Jacksonville, FL: Humid climate and proximity to the ocean can lead to faster vehicle degradation.

- Indianapolis, IN: A central location in the Midwest makes it a hub for auto recycling and junk car sales.

- Austin, TX: A rapidly growing city with an increasing number of vehicles and a need for junk car services.

- Columbus, OH: The largest city in Ohio has a steady demand for used car parts from junk vehicles.

- Fort Worth, TX: Part of the Dallas-Fort Worth metroplex, it has a large market for automotive recycling.

- Charlotte, NC: A growing city with an expanding need for junk car removal and recycling services.

- Seattle, WA: High environmental consciousness drives the recycling of junk cars for parts and scrap metal.

- Denver, CO: The city's focus on sustainability supports a strong market for recycling junk vehicles.

- El Paso, TX: Proximity to the Mexican border influences a cross-border trade in used car parts from junk vehicles.

These cities represent some of the most active locations for selling junk cars in the US, driven by factors such as population density, climate, economic conditions, and regional automotive trends.

What Are The Most Popular Junk Cars to Sell?

The most popular junk cars to sell are often those that are common, have a high demand for parts, or are heavy (as scrap metal value is based on weight). Some examples include:

- Honda Civic: A popular car with a high demand for parts.

- Toyota Camry: Known for its reliability, the Camry's parts are often sought after.

- Ford F-150: As a commonly used truck, its parts are in high demand.

- Chevrolet Silverado: Another popular truck with valuable parts.

- Nissan Altima: A widely driven car, making its parts easy to sell.

The popularity of a junk car can vary based on location, current market trends, and the condition of the vehicle.