Get Your Instant Offer

Sell Your Car for Cash

Selling your car for cash should be simple. At Junk Car Medics, we make it that way. Whether your vehicle is used, old, high-mileage, or junk, we give you a guaranteed offer and free pickup. No lowballing. No games. Just real offers and fast payments.

We buy:

- Used cars

- High-mileage vehicles

- Damaged or wrecked cars

- Non-running vehicles

- Cars with mechanical problems

- Salvage and junk cars

Wherever you are, we help you sell your car for cash the right way.

How to Sell Your Car Online for Cash

Sell your car online or by phone as fast as today with Junk Car Medics. Here's how it works

-

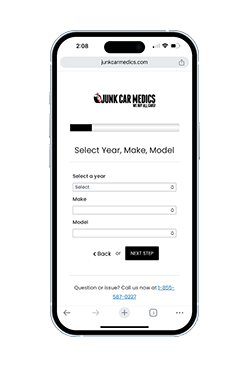

Step 1: Submit Vehicle Details

Tell us your vehicle’s year, make, model, mileage, and condition.

-

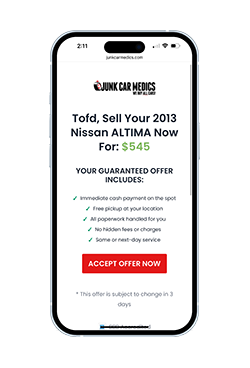

Step 2: Receive Instant Quote

We evaluate your vehicle based on condition, demand, and the local market. Get your offer by online or by phone in minutes.

-

Step 3: Schedule Free Pickup

Choose a convenient pickup window that works for you. We offer same-day and weekend pickups. We'll tow your vehicle for free from anywhere.

-

Step 4: Get Paid Cash

When we arrive, we inspect the vehicle, complete any paperwork, and pay you cash or check on the spot in exchange for your keys. No delays. No fees. No surprises.

How Much Can I Sell My Car for?

Car values vary depending on multiple factors. These include:

- Vehicle age, mileage, and condition

- Market demand for your make and model

- Whether it’s driveable or has valuable parts (like a catalytic converter)

- Metal prices, for older or junk vehicles

\We pay anywhere from $300 for junk cars to $10,000 or more for used and repairable vehicles. Your instant offer reflects your specific car’s real market value.

Here are recent payments we made to sellers:

| Vehicle | Price | Condition |

|---|---|---|

|

2008 Toyota 4Runner

ZIP 75098

|

$2,795

|

Non-RunningClean TitleNo Damage

|

|

2014 Land Rover LR2

ZIP 46201

|

$1,180

|

DrivesClean TitleNo Damage

|

|

2015 Jeep Wrangler

ZIP 79938

|

$3,670

|

DrivesClean TitleHas Damage

|

|

2005 Hummer H2

ZIP 54613

|

$2,275

|

Starts OnlyClean TitleNo Damage

|

|

2011 Ford Escape

ZIP 19126

|

$1,895

|

DrivesClean TitleNo Damage

|

|

2013 Ford F-150

ZIP 43950

|

$1,350

|

DrivesClean TitleHas Damage

|

|

2011 Chevrolet Silverado 1500

ZIP 78203

|

$2,165

|

DrivesClean TitleHas Damage

|

|

2016 Toyota Corolla

ZIP 30013

|

$3,125

|

Non-RunningClean TitleNo Damage

|

|

1997 Toyota 4Runner

ZIP 95691

|

$1,610

|

DrivesClean TitleNo Damage

|

|

2013 Ram 1500

ZIP 33549

|

$1,245

|

Non-RunningClean TitleHas Damage

|

|

2013 Ram 1500

ZIP 33549

|

$2,115

|

Non-RunningClean TitleNo Damage

|

|

2013 Ram 1500

ZIP 33549

|

$1,245

|

Non-RunningClean TitleHas Damage

|

|

2013 Subaru Impreza

ZIP 16052

|

$1,015

|

Starts OnlyClean TitleHas Damage

|

|

2016 Honda Odyssey

ZIP 11379

|

$1,485

|

Non-RunningClean TitleHas DamageMissing Wheels

|

|

2016 Chevrolet Impala

ZIP 72076

|

$1,015

|

Non-RunningClean TitleNo Damage

|

|

2018 Nissan Altima

ZIP 90808

|

$1,095

|

Non-RunningClean TitleHas Damage

|

|

ZIP 43130

|

$1,015

|

Starts OnlyClean TitleNo Damage

|

|

2019 Kia Soul

ZIP 46224

|

$1,300

|

DrivesSalvageHas Damage

|

|

2012 Mercedes-Benz M-Class

ZIP 70809

|

$2,780

|

DrivesClean TitleNo Damage

|

|

2010 Lexus RX 350

ZIP 18704

|

$2,285

|

Starts OnlyClean TitleHas Damage

|

|

2006 Toyota Corolla

ZIP 75228

|

$1,015

|

DrivesSalvageHas Damage

|

|

2008 Ford F-150

ZIP 77581

|

$1,635

|

DrivesClean TitleNo Damage

|

|

2017 Dodge Journey

ZIP 85204

|

$1,045

|

Starts OnlyClean TitleNo Damage

|

|

2006 GMC Sierra

ZIP 72701

|

$1,230

|

DrivesClean TitleNo Damage

|

|

2015 Ford F-150

ZIP 72701

|

$2,555

|

DrivesClean TitleNo Damage

|

|

2019 Ford Fusion

ZIP 85225

|

$1,575

|

DrivesClean TitleNo Damage

|

|

2011 Jaguar XK-Series

ZIP 86004

|

$1,520

|

Starts OnlyClean TitleNo Damage

|

|

2011 Toyota Camry

ZIP 76542

|

$1,335

|

DrivesClean TitleHas Damage

|

|

2018 Hyundai Kona

ZIP 10548

|

$2,235

|

Starts OnlyClean TitleNo Damage

|

|

2017 Dodge Journey

ZIP 85204

|

$1,045

|

Starts OnlyClean TitleNo Damage

|

All offers shown are actual cash amounts paid to vehicle sellers in the local area. Data updated daily.

Why Sell Your Car With Us?

Our car buying service is the fastest way to sell a vehicle for money. We're not a dealership, and we're not a lead service. We are a national network of direct buyers who offer fair pricing and stress-free service.

- Top offers based on real-time market data

- No fees for pickup, quotes, or processing

- Same or next-day removal

- Licensed and insured buyers

- Thousands of 5-star reviews

- A+ BBB Rating for trust and transparency

We’ve helped over 75,000 people sell their cars for cash. Let us help you next.

Sell Your Car Online From Anywhere in the US

One of the great benefits of our car buying service is it allows you to sell your car online from anywhere in the US. We service the entire nation, coast to coast. Top cities include:

- Sell my car online in Charlotte

- Sell my car online in Chicago

- Sell my car online in Dallas

- Sell my car online in Detroit

- Sell my car online in Houston

- Sell my car online in Los Angeles

- Sell my car online in Milwaukee

- Sell my car online in Philadelphia

- Sell my car online in Phoenix

- Sell my car online in Tampa

Get Your Instant Offer Now

Ready to sell your car for cash? Get a no-obligation offer in minutes and have your vehicle picked up for free. Fast cash, no hassles, and no pressure.